Recharge of cost (VAT)

This article explains the distinction between commissions subject to VAT and reimbursements of disbursements not subject to VAT. It discusses the implications for groups of companies and partial taxpayers, and the “separate sectors” option for optimizing VAT deductions.

The “VAT package” on electronic services from July 2021

This article outlines new EU VAT rules for e-commerce, detailing the One-Stop Shop (OSS) and Import One-Stop Shop (IOSS) regimes, relevant procedures, registration requirements, and benefits for businesses in Luxembourg, to simplify VAT collection and compliance on cross-border distance sales.

eCDF integrates eTVA in Luxembourg

The Luxembourg eCDF platform replaces eTVA for preparing, validating, and filing VAT declarations. It streamlines data entry, offers real-time validation, secure LuxTrust access, and automatic calculations. Declarations transmit instantly to AEDT, ensuring efficiency, transparency, and traceability.

VAT registration

VAT registration is mandatory for establishing a company or self-employed activity in Luxembourg. It involves enrolling as a taxable person within 15 days of starting operations, declaring changes in activity, and deregistering upon cessation. Proper supporting documentation is essential throughout.

VAT on e-commerce services in Luxembourg

This article details Luxembourg’s VAT regulations for e-commerce, covering distance sales of physical goods, electronic services, and new measures like the OSS and IOSS systems. It also explains thresholds, registration obligations and import procedures.

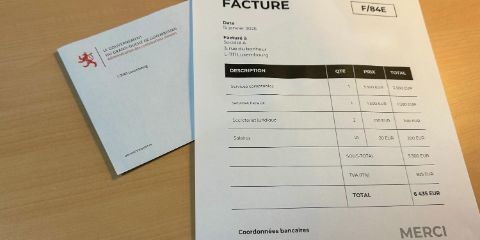

VAT: mandatory information on invoices

This article details Luxembourg’s mandatory VAT invoice requirements, including essential information (VAT numbers, dates, taxable amounts, etc.), simplified invoices under EUR 100, acceptance of e-invoicing, and deadlines. It emphasizes strict compliance to safeguard the right to deduct and avoid penalties.

VAT in Luxembourg

Natural or legal persons carrying out an activity subject to VAT are liable to this tax. They have to follow certain terms and conditions, they have to make sure they have the right rates, and they can apply for a refund of surplus.

VAT rules applicable to online business

Since July 2021, Luxembourg e-commerce companies apply the OSS scheme to simplify VAT for cross-border sales via Internet. Products sold to professionals follow standard rules, while consumer sales exceeding the threshold of EUR 10,000 use destination country VAT.

VAT rate for TV and radio broadcasts

Luxembourg has four VAT rates: 17% (standard), 14% (intermediate), 8% (reduced), and 3% (super-reduced). The super-reduced rate applies to essential goods and paid broadcasting services for VAT, while downloads and cloud services remain taxed at 17%.