THE IMPACT OF THE TAX REFORM ON MARRIED CROSS-BORDER COUPLES

Let’s consider the changes in legal and regulatory provisions from the main perspective of non-resident married couples (i.e. cross-border married couples) employed or retired in Luxembourg.

No less than 150,000 letters from the Direct Tax Administration have been sent since the beginning of October to non-resident married taxpayers (employees or pensioners), asking them to state their position before 31 October 2017 as to their choice of taxation following the implementation of the tax reform which came into force on 1 January 2017.

THE TAX REFORM IN BRIEF

The tax reform stipulates that as from 1 January 2018 non-resident married couples with professional income taxable in the Grand Duchy will automatically be assimilated to class 1 - in application of the modified article 157bis L.I.R. Each spouse will be taxed on their own income in the same way as a single taxpayer, without taking into account any children which may be present in the household. This also applies when only one of the spouses works in Luxembourg.

However, married cross-border couples may apply to be treated in the same way as resident taxpayers for tax purposes in order to benefit from the same legal provisions in terms of deductions, allowances and credits, subject to meeting certain prerequisites.

CONDITIONS FOR TAX EQUIVALENCE TO RESIDENT TAXPAYERS

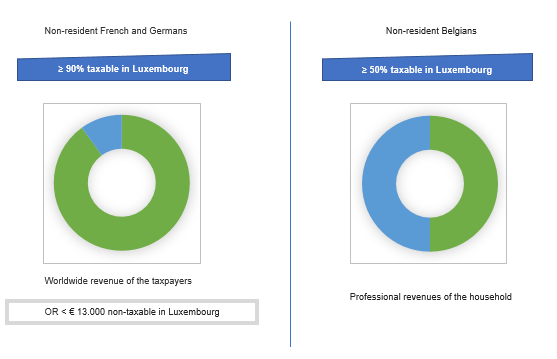

Prior to the tax reform, married cross-border couples could be considered as equivalent to residents for tax purposes if at least 90% of the professional income of one of the spouses originated in Luxembourg (and 50% for Belgians). According to article 157bis L.I.R., professional income includes:

- commercial profit,

- agricultural and forestry profits,

- profit from the exercise of a liberal profession,

- net income from salaried employment,

- net income from pensions and annuities comprised pensions received under a former salaried occupation and those paid from an autonomous pension fund.

Henceforth, non-resident married couples may be considered equivalent for tax purposes to resident taxpayers provided that at least 90% of the worldwide income of one of the spouses originates in Luxembourg(1) or that their income from foreign sources does not exceed 13,000 euros per year, even if this income exceeds 10% of their worldwide income(2) .

According to article 156 L.I.R., worldwide income, whether from Luxembourg or foreign sources, is composed of:

- the above-mentioned professional income,

- income from movable capital (dividends),

- income from the rental of property,

- and finally, miscellaneous income within the meaning of Articles 99bis to 101, whether originating from Luxembourg or foreign sources (profit from speculation, disposal of important shareholdings etc.).

For married couples living in Belgium, it is sufficient that at least 50% of only the household's professional income originates from Luxembourg sources to be treated as a resident taxpayer for tax purposes.

Summary of tax equivalence conditions

THE CASE OF EMPLOYEES WORKING IN SEVERAL COUNTRIES

Whether they are a resident or not, beyond a certain number of days of work outside Luxembourg by a Luxembourg employee the taxpayer becomes taxable on the part of their income in the country where the service was provided. This means that this country is entitled to tax the relative share of income generated on its territory.

Nevertheless, there are tolerance thresholds below which the countries concerned do not tax the income, meaning it is fully taxable in Luxembourg. In Belgium and Germany, the thresholds are 24 days and 19 days per year respectively.

In order to provide more flexibility in the application of the 90% rule for income sourced in Luxembourg, the latter sets a threshold of 50 days per year(2). When a Luxembourg employee (resident or not) works less than 50 days per year in their country of residence or in a country other than Luxembourg, then their income taxed in this other country will be considered as Luxembourg source income.

TAX REGIME SELECTION

As long as married couples who are non-residents of France, Germany and Belgium meet the conditions to be treated in the same way as resident taxpayers for tax purposes, there are three options to be considered:

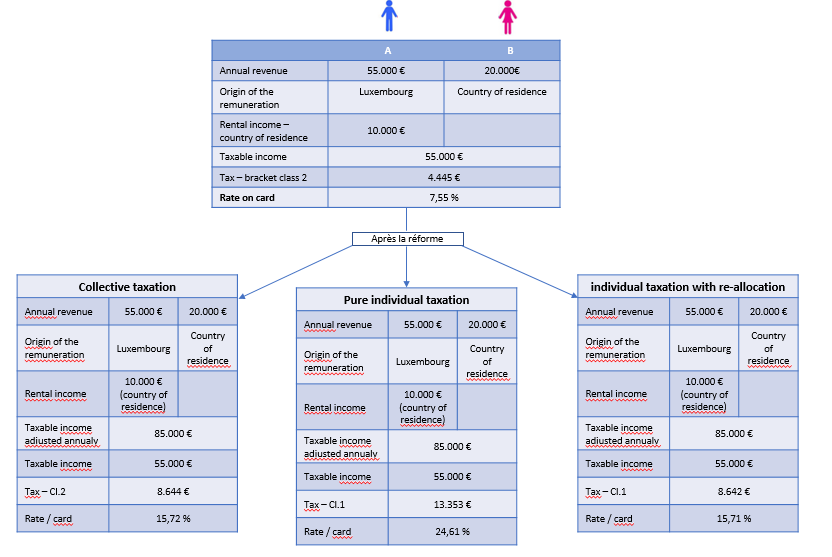

- Collective taxation of the worldwide income of both spouses on the basis of a rate calculated in accordance with the scale for tax class 2 and applicable to Luxembourg income.

The tax card no longer mentions a class, but rather a rate. With this option, both spouses are jointly responsible for the payment of household tax and a joint tax return is compulsory.

- Pure individual taxation: each spouse is individually liable for their own tax on their worldwide income solely. Here too, the rate mentioned on the tax card is determined according to the class 1 scale. This rate then applies only to income from Luxembourg sources to determine the amount due. In this case, the spouses are not jointly liable for tax and the joint tax return is obligatory. Any deductions and other extra-professional allowances are divided equally between each spouse.

- Individual taxation with reallocation: this option has the advantage that you are able to define the income to be allocated to each of the spouses in order to respect a balance and equity within the couple based on each spouse's income. The administration applies a 50% distribution by default. As a result, each spouse is then taxed on his or her relative share of the reallocated household's worldwide income. The rate mentioned on each spouse's tax card is defined according to the class 1 scale. The responsibility for tax payment is limited and tax declaration is compulsory. Tax deductions and extra-professional allowances are deducted from household income before the reallocation is applied.

For the 2018 tax year, the choice of tax method between collective taxation, pure individual taxation or with reallocation can be made until 31 March 2019. Beyond this date, the choice made is irrevocable (2). Note that this choice must be made by both spouses (Application for individualisation).

Example

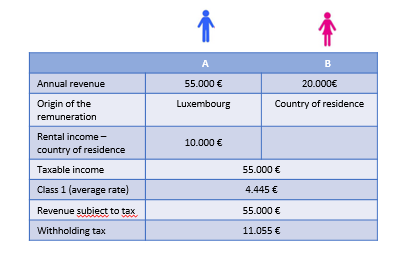

Let’s take the example of a non-resident married couple where one of the taxpayers (A) works in Luxembourg and the other (B) in their country of residence (in France or Germany).

(A) has an overall income of 65,000 euros of which 10,000 euros is from non-Luxembourg sources, which means that his income from Luxembourg sources only represents 85% of his worldwide income (55,000*100/65,000) if the taxpayer resides in France or Germany, whereas it represents 100% of his professional income for the taxpayer who resides in Belgium.

For taxpayers resident in France or Germany, the 90% rule is not respected, but since the income from non-Luxembourg sources is less than 13,000 euros, they can claim to be treated in the same way as a resident.

The income to be taken into account for the calculation of the tax rate is the worldwide income, i.e. 85,000 euros (55,000 + 10,000 + 20,000).

The income subject to Luxembourg tax is only the income from Luxembourg sources, i.e. 55,000 euros.

Let's look at the choices available to taxpayers who reside in France or Germany.

If taxpayers residing in France or Germany decide to take no further action on the mail received by the Administration des Contributions Directes, then class 1 will be applied:

In order to determine the best possible tax option according to your situation, it is useful to make online simulations via "MyGuichet". Our advisers are also at your disposal to study your file and identify the optimal choice for you.

(1) Pursuant to 157ter L.I.R.

(2) Subject to parliamentary approval

.jpg)