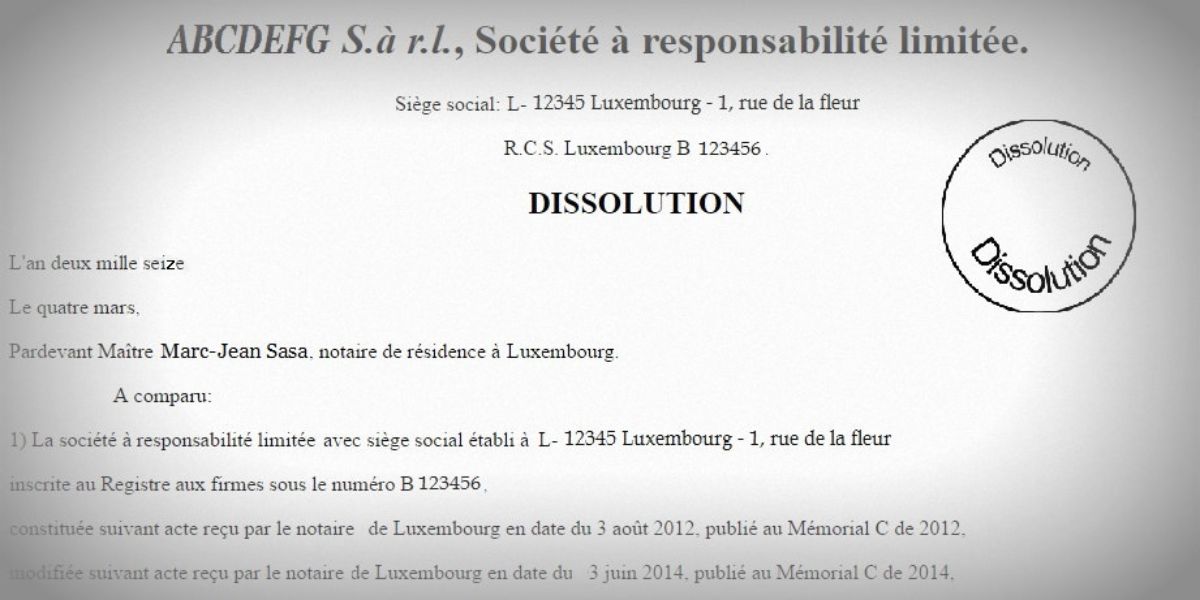

There is among the general population some confusion between the terms « dissolution », « simplified liquidation », « judicial liquidation »… This confusion is partially due to lawmakers themselves:

- Article 1865 bis of the civil code covers dissolutions without liquidations;

- Article 141 of the law on commercial companies states that after dissolution, companies continue to exist for the purpose of their liquidation.

- Section XII bis of the same law deals with “dissolution and judicial liquidation of commercial companies.”

Two types of dissolutions are in fact possible: voluntary dissolution and compulsory dissolution. These two types of dissolutions are followed by a liquidation period of varying duration.

For voluntary dissolutions, practice has led (based on article 1865 bis of the civil code) to the implementation of a “simplified liquidation”, reinforced by the law of August 10th 2016.

Reunion of all the shares in one hand

Liquidations can be more or less complex. In the case where one individual holds the entirety of the shares of a company (and therefore all the assets and liabilities), it turned out that it was very costly and time consuming to follow all the procedures. Many steps of a regular liquidation are in that case useless since their purpose is to equitably allocated the liquidation surplus between shareholders.

The law on modernization of company law

The law on modernization of company law1 confirmed the practice of public notaries of dissolving companies without liquidation when an individual held all the shares. The law modified article 141 of the law on commercial companies and specified which documents are needed at the general meeting of dissolution.

Simplified liquidations existed before the reform but these operations were not really supervised by law. Practice changed from public notary to public notary and some did not even perform them.

The law has allowed to standardize the practice and any shareholder can decide to quickly liquidate his company if he holds all the shares (article 1865 bis of the civil code, unchanged) and under the condition that the company provides certificates showing that it is up to date with the payment of all taxes. The certificates are from:

- The social security center

- The direct tax administration

- The VAT administration

In order to carry that simplified liquidation, the company must provide these certificates to the public notary and they cannot date back further than three months before the date of the liquidation (nor be dated after that date).

Furthermore, article 1865 bis protects the creditors of the company. Creditors can indeed, in a 30 days delay following the publication of the dissolution act, obtain guarantees.

This new law, even if it consolidates a widespread practice, mainly aims at standardizing the procedure and at more effectively protecting the Luxembourg administrations from a default of the shareholders from the dissolved company.

We believe that the procedure is best used when the shareholder is a natural person. When the shareholder is a legal person, it is best to go through a simplified fusion.

(1) Law of August 10th 2016 on the modernization of the modified Law of August 10th 1915 on commercial companies